Simplify the tax compliance process: The Power of QuickBooks Online with Payroll

Managing payroll is one of the most time-consuming and complex tasks for any business owner. It demands precision and timeliness, from calculating wages to ensuring compliance with ever-changing regulations. For instance, businesses with remote teams or multiple locations face an even greater challenge.

Enter QuickBooks Online Payroll (QBO Payroll). This is a robust, cloud-based solution designed to simplify the entire process. Ultimately, it offers advanced features that perfectly cater to the needs of modern, distributed teams. First decide on the best quickbooks online subscription, then activate payroll to your organizations needs.

Payroll Management: Anytime, Anywhere

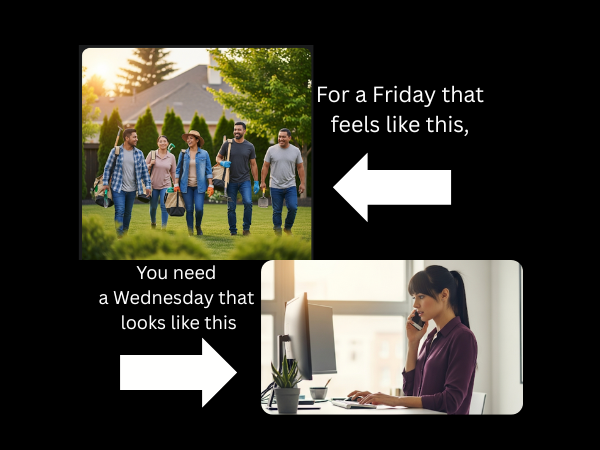

QBO Payroll’s cloud-based nature is its greatest strength, offering unparalleled flexibility:

- Remote Access for Owners and Managers: You can access and manage payroll from anywhere with an internet connection. Review data, approve timesheets, and run payroll whether you’re traveling or working from home.

- Real-time Visibility: Instantly view payroll summaries, employee details, and tax information. There’s no more waiting for reports; you can make quick, informed decisions.

- Permission-Based Control: Set up different access levels for security. For example, a manager can approve timesheets, while only an owner or HR person can finalize runs and access sensitive financial data.

Seamless Integration with Time Tracking

For businesses that pay hourly employees or need to track time for project billing, QBO Payroll offers powerful integrated time tracking:

- Built-in Clock-in/Out: Employees easily clock in and out using the QuickBooks Workforce app or a web browser.

- Automatic Calculation: Time data flows directly into payroll, eliminating manual entry. The system automatically calculates regular hours, overtime, and Paid Time Off (PTO) based on your policies.

- Manager Approval Workflows: Managers must review and approve employee timesheets before they are processed for payment. This ensures accountability.

Stress-Free Tax Compliance

One of the biggest headaches of payroll is ensuring all taxes are paid correctly and on time. Fortunately, QBO Payroll takes this significant burden off your shoulders:

- Automated Federal Tax Payments: The system automatically calculates and pays all federal payroll taxes (Social Security, Medicare, etc.). It also handles the preparation and filing of your quarterly Form 941.

- State Tax Compliance: QBO Payroll manages state-specific payroll taxes, including unemployment insurance and income tax withholding. This ensures you meet all state deadlines and avoid penalties.

- Guaranteed Accuracy: Built-in compliance features often come with a tax penalty protection guarantee. This gives you peace of mind that your payroll taxes are handled correctly.

Effortless Year-End W-2s

The annual task of preparing and distributing W-2 forms is simplified immensely:

- Automatic W-2 Generation: Accurate W-2 forms are automatically generated based on the payroll data processed throughout the year.

- Electronic Filing: The system handles the electronic filing of W-2s with the Social Security Administration (SSA), meeting all federal requirements.

- Secure Employee Access: Employees can securely access and download their W-2s through the QuickBooks Workforce portal. This reduces the need for physical mailing.

Is QBO Payroll Right for You?

If you are looking to reduce the administrative burden, ensure tax compliance, and empower your team with flexible access, QuickBooks Online Payroll is the solution.

It is especially beneficial for:

- Businesses with remote employees or multiple locations.

- Companies that need integrated time tracking.

- Owners who want to minimize the risk of payroll tax errors and penalties.

By leveraging QBO Payroll, you can transform a complex, time-consuming task into a streamlined, efficient, and worry-free process. Ultimately, this allows you to focus on growing your business.